We are banker of your dream!

We make sure that you achieve all your Financial Goals with right amount in right duration.

There can be multiple point of cash flow which needs to be arranged for, to avoid any sudden financial crisis or shortfall

driving a car, without knowing where to Go!

We make sure that you achieve all your Financial Goals with right amount in right duration.

There can be multiple point of cash flow which needs to be arranged for, to avoid any sudden financial crisis or shortfall

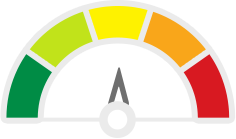

Every mutual fund product is divided into one of these five Risk category , as defined and mandated by SEBI

The below table gives a snapshot of risk profiles of some mutual fund categories as promoted by us:

| Low Risk | Moderately Low Risk | Moderate Risk | Moderately High Risk |

|---|---|---|---|

| Liquid Funds | Short-duration Funds, Ultra Short-duration Funds | Fixed Maturity Plans (FMPs) | Large Cap Funds, Mid and Small Cap Funds, Balanced Funds |

Government of India has announced to launch Floating Rate Savings Bonds, 2020 (Taxable) scheme commencing from July 01, 2020 to enable Resident Indians/HUF to invest in a taxable bond, without any monetary ceiling

Use details exactly from this link https://www.hdfcsec.com/rbi-bond

54EC bonds, or capital gains bonds, are one of the best way to save long-term capital gain tax. 54EC bonds are specifically meant for investors earning long-term capital gains and would like tax exemption on these gains. Tax deduction is available under section 54EC of the Income Tax Act. 54EC bonds do not allow any tax exemption on short-term capital gains tax. Invest in 54EC bonds to get benefits of tax deduction. The maximum limit for investing in 54EC bonds is Rs. 50,00,000. The eligible bonds under Section 54EC are REC (Rural Electrification Corporation Ltd), PFC (Power Finance Corporation Ltd) and NHAI (National Highways Authority of India) and IRFC (Indian Railways Finance Corporation Limited).

Fixed deposit is investment instruments offered by banks and non-banking financial companies, where you can deposit money for a higher rate of interest than savings accounts. You can deposit a lump sum of money in fixed deposit for a specific period, which varies for every financier.

Once the money is invested with a reliable financier, it starts earning an interest based on the duration of the deposit. Usually, the defining criteria for FD is that the money cannot be withdrawn before maturity, but you may withdraw them after paying a penalty.

Fixed deposit is investment instruments offered by banks and non-banking financial companies, where you can deposit money for a higher rate of interest than savings accounts. You can deposit a lump sum of money in fixed deposit for a specific period, which varies for every financier.

Once the money is invested with a reliable financier, it starts earning an interest based on the duration of the deposit. Usually, the defining criteria for FD is that the money cannot be withdrawn before maturity, but you may withdraw them after paying a penalty.

You can understand which risk profile is suitable for you with the help of the below table:

| Risk Profile | Type of Investor |

|---|---|

| Low Risk | Investors willing to accept low returns for high safety of principal amount. |

| Moderately Low Risk | Investors willing to take a small amount of risk for potential returns. |

| Moderate Risk | Investors willing to accept a moderate level of risk for moderate returns. |

| Moderately High Risk | Investors willing to take relatively high risk for high returns. |

| High Risk | Investors willing to lose capital for significantly high returns. |

Investment Vridhi encourages you to align your Risk profile with the product Risk profile. Remember,

everytime you make your investments, you must score your self ( under the scale of 0 to 10) in terms of : S : Safety | L : Liquidity | R : Returns

Say example, you give 8 points to Safety then you are left with 1 point each for Liquidity and returns . And if you give 8 points to Returns the you are left with 1 point each for Safety and Lqiuidity.

So it is a simple game of Risk vs Reward ! You have decide the quantum of Risk according to your desired reward.

Our commitment to our investors : We provide you the most suitable product for investments and your wealth growth. We have a special Risk Profiling process in place to do the same

-Mrigendra Kumar Mishra, Chief Counsellor

Create a Goal with our Free Financial calculator Tool, and save it under your

secured login at www.investmentvridhi.com